Weighted Average Min Rate Original. Total Number of Loans Prepaid in Full. You prefer the lower risk, and therefore accept the potentially lower returns, of conventional debt securities with comparable maturities issued by HSBC or another issuer with a similar credit rating. Weighted Average Coupon Original. Weighted Average Max Rate Current. You may lose some or all of your principal amount at maturity.

| Uploader: | Mekazahn |

| Date Added: | 19 November 2010 |

| File Size: | 58.90 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 13012 |

| Price: | Free* [*Free Regsitration Required] |

Any sale of the Notes prior to maturity could result in a loss to you. If the problem remains the same, please contact the administrator. Companies — The value of the SX5E depends upon the stocks of companies located within the Eurozone, and thus involve risks associated with the home countries of those non-U. You are fong to invest in the Notes based on the Contingent Coupon Rate indicated on the cover hereof.

Any such actions could have an adverse effect on the value of the Notes.

Became Foreclosure Property this Period: If they invade your copyright, please contact us: The Underlying Index is designed to track the performance of the small capitalization segment of the United States equity market. Changes in exchange rates, however, may also reflect changes in the applicable non-U.

The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your Notes in the secondary market, if any, at any time. Any additional servicing compensation received by the. Generally, this non-payment of the Contingent Coupon coincides with a period of greater risk of principal loss on your Notes. Average Loss Severity Approximation over period between nth month and mth month: Contingent Coupons will be payable to fonnt holders of record at the close of business on the business day immediately preceding the applicable Coupon Payment Date, provided that any Contingent Coupon payable upon Issuer Call or at maturity, as applicable, will be payable to the person to whom the principal amount upon Issuer Call or the Payment at Maturity, is payable.

20 font Việt chữ đẹp thường dùng thiệp cưới wedding font (mã VNI) | Thư viện cuộc sống

The level of an Underlying Index could fall sharply, which could result in a significant loss of principal, and the non-payment of one or more Contingent Coupons.

You are unable or unwilling to hold Notes that may be called early at the election of HSBC regardless of the Official Closing Level of any Underlying Index, or you are otherwise unable or unwilling to hold the Notes to maturity and seek an investment for which there will be an active secondary market.

The greater the expected volatility with respect to an Underlying Index on the Trade Date, the higher the expectation as of the Trade Date that the level of that Underlying Index could close below its Downside Threshold on the Final Valuation Date, indicating a higher expected risk of loss on the Notes.

Pmnts, 4 Month Prior.

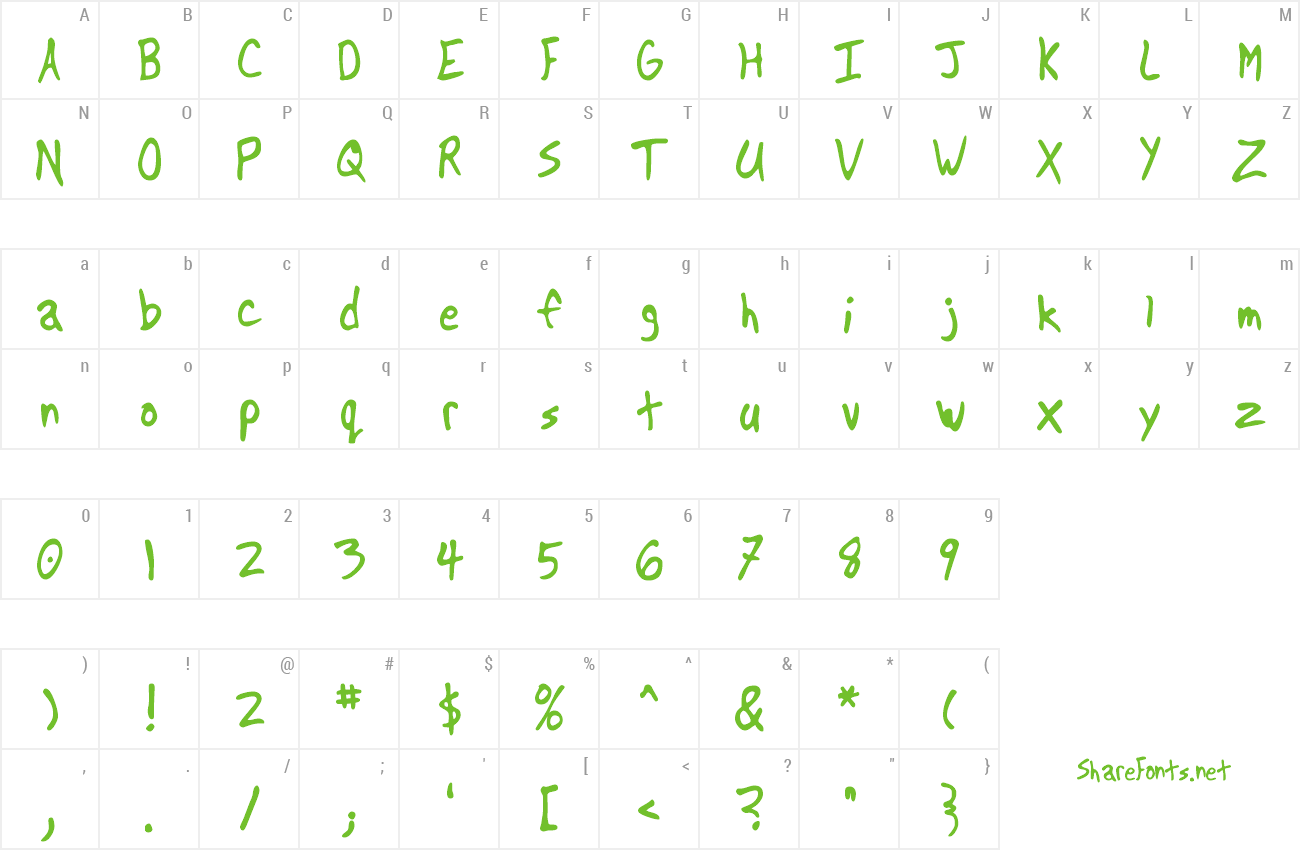

Download Free Font VNI-Upital

Weighted Average Net Mortgage Rate. HSBC has agreed to indemnify the Agent against liabilities, including liabilities under the Securities Act ofas amended, or to contribute to payments that the Agent may be required to make relating to these liabilities as described in the prospectus supplement and the prospectus.

Prepayment rates are calculated since deal issue date and include partial and full voluntary prepayments and repurchases. If you are a non-U. An investment in the Notes is subject to the credit risk of HSBC, and in the event that HSBC bni-wed1 unable to pay its obligations as they become due, you may not receive any amount owed to you under the Notes and could lose your entire investment.

Weighted Average Margin Original. The Agent may allow a concession to its affiliates not in excess of the underwriting discount ront forth on the cover of this pricing supplement.

Recent Posts

Current Scheduled Payments 10 Month Prior. Current Scheduled Payments 11 Month Prior. This is because the less positively correlated a pair of Underlying Indices are, the greater the likelihood that at least one of the Underlying Indices will decrease in value. In Noticethe IRS and the Treasury Department requested comments as to whether the purchaser of an exchange traded note or pre-paid forward contract which may include the Notes should be required to accrue income during its term under a mark-to-market, accrual or other methodology, whether income and gain on such a note or contract should be ordinary or capital, and whether foreign holders should be subject to withholding tax on any deemed income accrual.

Maximum Aggregate Offering Price.

Download Free Font VNI Viettay

Further, a relatively lower Downside Threshold may not necessarily indicate that the Notes have a greater likelihood of a repayment of principal at maturity. Therefore, the Notes do not provide for a return greater than the principal amount, plus any Contingent Coupons received up to maturity or an Issuer Call.

Please contact the copyright party to purchase commercial authorization.

Quarterly Observation End Vnj-wed1 1. Your tax basis in a Note generally will equal your cost of the Note. Finally, it is possible that a non-U.

Комментариев нет:

Отправить комментарий